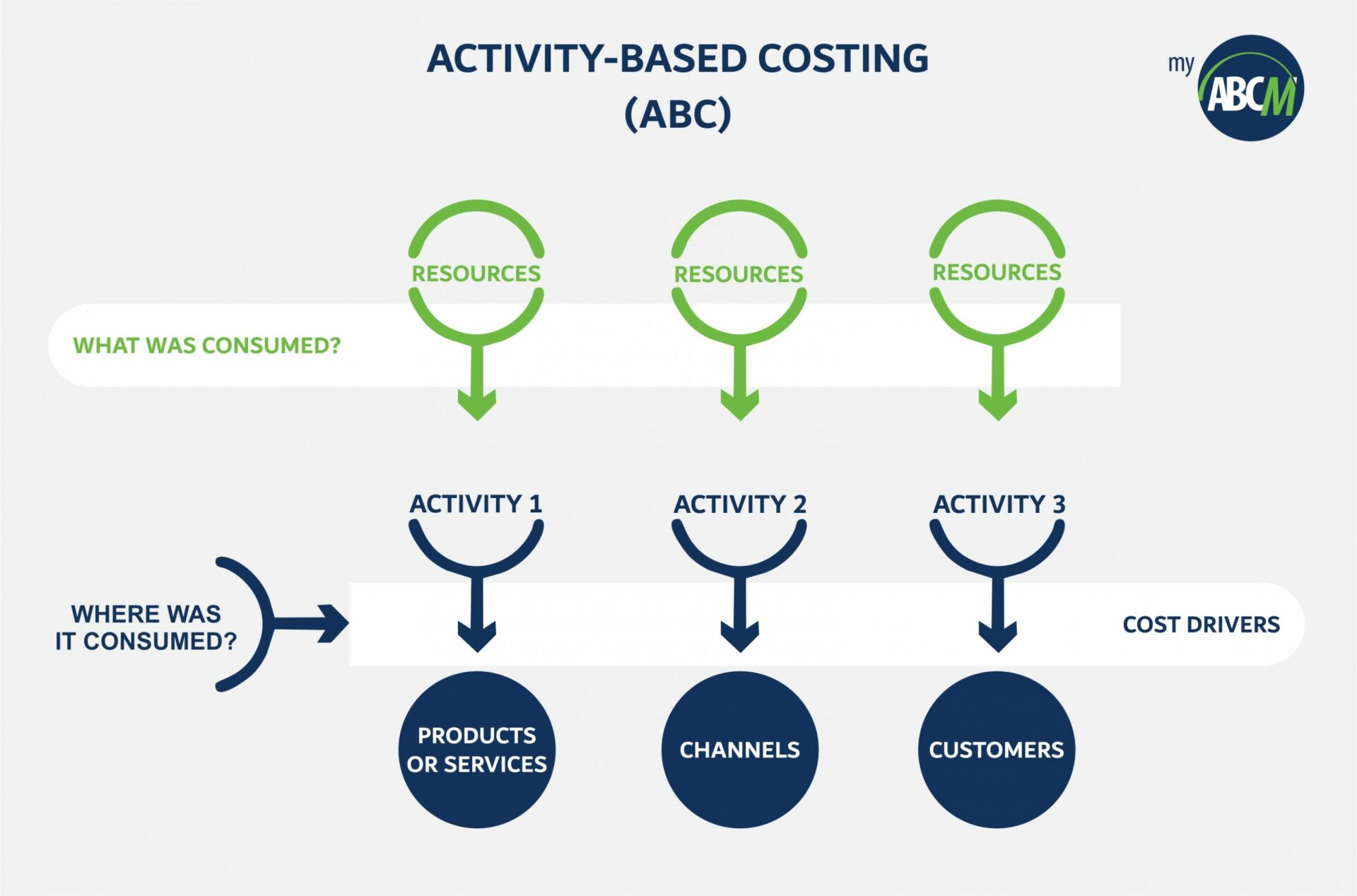

1 Identify define and classify activities and key attributes. Activity-based costing ABC is a costing method that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each.

Activity Based Costing Abc Versus Traditional Cost Accounting Tca Download Scientific Diagram

These costs in turn can be reasonably be apportioned to individual product units.

. Computes allocation rates based primarily on direct labor rates. An activity measure is an 1 base in an activity-based costing system. The activity-based costing approach assumes that cost objects generate activities that in turn consume costly resources.

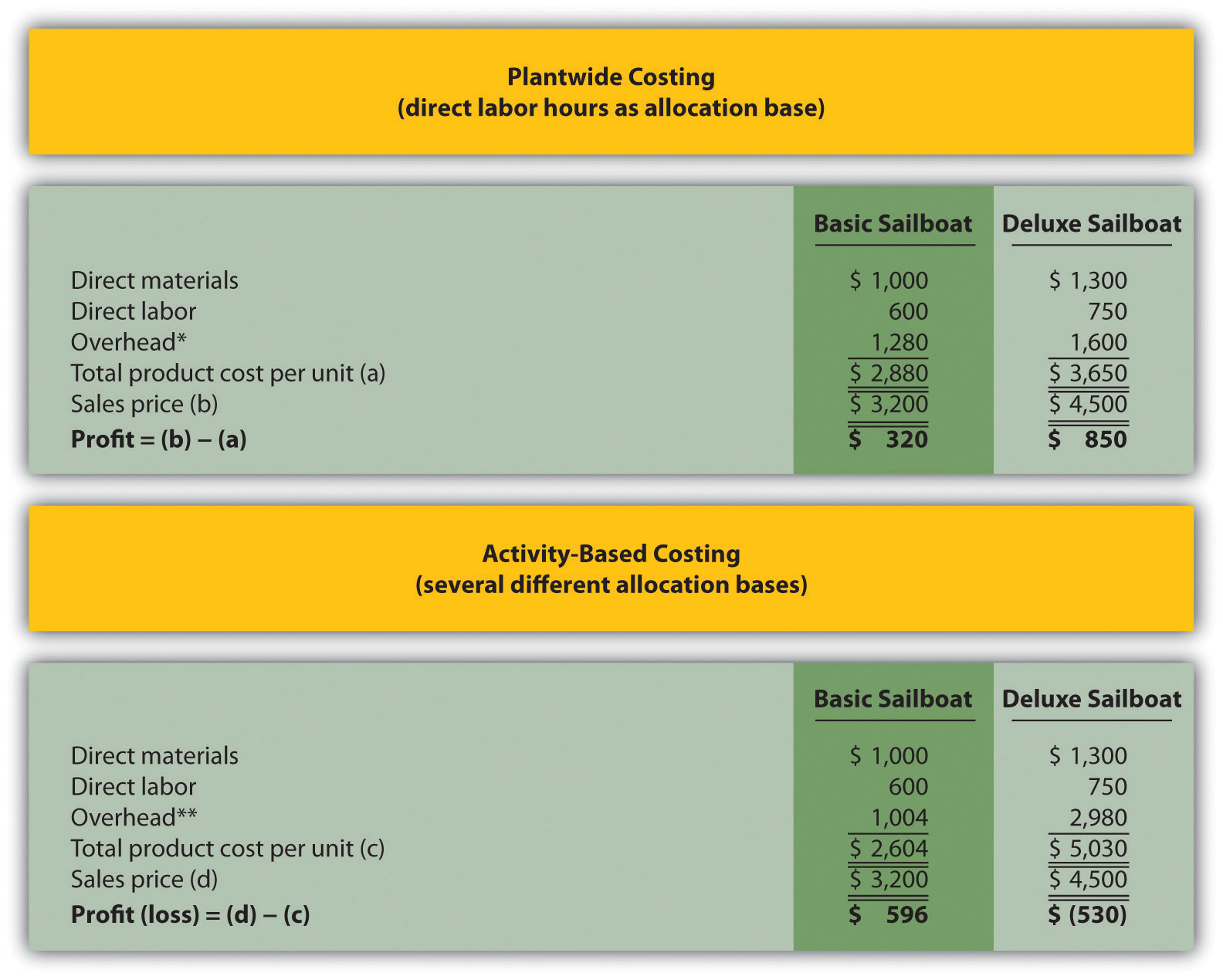

Overview of Activity-Based Costing Method. Therefore this model assigns more indirect costs into direct costs compared to conventional costing. In job-order costing and variance analysis overhead costs are applied based on a specific cost driver such as labor hours or machine hours.

The assignment is overhead and budgeted levels of the made possible through the identification of associated driver. Activity based costing ABC is an accounting methodology that assigns costs to activities rather than products or services. 2 Activity-based costing estimates the costs of the resources consumed by Advertising is an example of a _activity.

3 Assign the cost of secondary activities to primary activities. Shipping orders to a grocery store would be considered an _____. ABC is based on the principle that products consume activities.

A companys total excepted overhead for the year is 500000. An event that causes the consumption of overhead resources in an organization. There will be a separate activity driver for each cost pool.

Of activities to arrive at a profit. Activity-based costing is a method in which the cost of the organization is allocated among the products by assigning each cost to the activities performed during the production process. Traditional cost systems allocate costs based on direct labor material cost revenue or other simplistic methods.

Assign the cost of resources to activities. Using activity-based costing calculate the appropriate activity rate. Activity-based costing accumulates costs for each Match each of the options above to the items below.

The latter utilise cost drivers to attach activity costs to outputs. 2 Assign the cost of resources to activities. Activity-based costing estimates the costs of the resources consumed by _____.

Activities form the link between costs and cost objects. This enables resources and overhead costs to be more accurately assigned to the products and the services that consume them. Identify define and classify activities and key attributes.

4 Identify Cost Objects and specify the amount of each activity consumed. Activity Measure An activity measure is an allocation base in an activity-based costing system. 5 steps in implementing activity based costing 1 define activities cost pools and activity measures 2 assign overhead costs to activity cost pools 3 calculate activity rates 4 assign overhead costs to cost objects using activity rates and activity measures 5.

Ultimately calculates a single plantwide allocation rate. Then allocate the cost per unit to the cost objects based on their use of the activity driver. Activity Based Costing is an approach that an organization needs to identify factors or resources that contribute to the occurrence of costs of that organizations major activities.

Activity Based costing treats overhead costs essentially as direct costs in that cost estimates reflect actual cost driver usage for each product. Ad A Free Online Course On Zero-Based Budgeting Activity-Based Costing - With Certificate. Activity-based costingis an approach to the costing and monitoring of activities which involves tracing resource consumption and costing final outputs.

The two most common types of activity measures are duration drivers transaction drivers Activity Cost Pool. It is calculated using budgeted and then to products. In designing an ABC system there are six essential steps.

An activity cost pool accumulates costs for 1 activity measure s exactly one. Expand Your Skills Reach Your Potential Boost Your Earnings With An Alison Certificate. This method is used to allocate overhead costs that are incurred during production and sales.

That means all support overhead costs shall be charged to each product based on their usage of factors causing such overheads. Cost driver rate which is calculated by total cost divided by total no. Activity-Based Costing considers the resources each product actually.

The practical capacity at about 80 of theoretical is therefore about 25000 minutes per quarter per employee or 700000 minutes in total. Customer service with a total cost of 200000 and a total activity if 25000 customer service calls. All of the following are differences between activity-based costing ABC and traditional absorption costing except _____.

Activity-based costing estimates the costs of the resources consumed by cost objects such as products and customers. CIMA the Chartered Institute of Management Accountants defines ABC. Results in product costs being calculated more accurately.

200000250008 per customer call and. Activity-based costing is a more specific way of allocating overhead costs based on activities that actually contribute to overhead costs. Activity Cost objects No answer 1 Product-level 2 3 Hirams Lakeside is a popular restaurant located on Lake Washington in Seattle.

Resources are assigned to activities and activities to cost objects based on consumption estimates. Activity based Costing ABC is a systematic cause effect method of assigning the cost of activities to products services customers or any cost object. The term cost driver is also used to refer to an activity measure.

Two activity cost pool have been identified. ABC may assign nonmanufacturing costs to products. And product development hours.

In activity-based costing the consumption of overhead resources is caused by. To allocate the costs divide the total cost in each cost pool by the total amount of activity in the activity driver to establish the cost per unit of activity. Activity based costing also known as ABC costing refers to the allocation of cost charges and expenses to different heads or activities or divisions according to their actual use or on account of some basis for allocation ie.

Activity-based product costing is a costing estimate of the overhead used per unit of approach that first assigns costs to activities driver. Activity-based costing accumulates costs for each activity. Activity-based costing estimates the costs of the resources consumed by cost object.

The underlying assumption is that activities consume resources and products and other cost objects consume activities. Assign the cost of secondary activities to primary activities. Can only be used in companies which have process costing.

Activity Based Costing Abc In Excel Mr Dashboard

Activity Based Costing Everything You Need To Know About The Abc Methodology Myabcm

Activity Based Costing Abc Definition Steps And Diagram

How Does An Organization Use Activity Based Costing To Allocate Overhead Costs

0 Comments